We talked about the principle of compounding here and gave you three ways the concept can help you save money, including how the principle can be applied to our behavior.

Now we’re going look at how it works with investing—the most common and powerful example of what compounding can do for us financially.

While you can invest short-term, we’re going to talk about investing for your retirement.

The long-term, cumulative effect of compounding is what makes it powerful. When you’re investing for your retirement, time becomes the most important factor.

But how far does that rule go?

Time vs. Quantity: Who Wins?

Let’s look explore that question with an example.

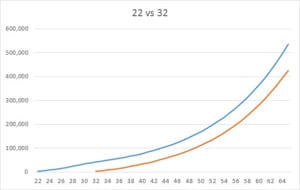

Eric saves $2,500 per year in a retirement account, starting when he graduates at 22. Then life gets busy and he has kids, so he quits contributing at 32.

Jack enjoys his twenties, partying and having fun, not worrying about retirement yet. He starts saving at 32, investing $2,500 a year—and he does this every year, until he’s 65.

Consequently:

Eric saves for 10 years x $2,500 = $25,000.

Jack saves for 33 years x $2,500 = $82,500.

Who’s at the advantage?

At an 8% return, here are the results at 65:

Eric has approximately $564,000.

Jack has approximately $425,000.

Even though Jack invested over 3x what Eric did, Eric ends up with over $100,000 more for his retirement—all because he started 10 years earlier.

The moral? Start NOW.

Don’t Let Excuses Stop You

“But I don’t have $2,500!”

That’s okay. You can start with small monthly deposits and increase them over time. It’s more important to start now, than it is to worry about what you’d like to “ideally” save every year.

Don’t forget, Jack contributed 3x as much as Eric, but Eric had over $100,000 more for his retirement.

In a race between Time and Quantity, Time won.

“But I’m already 32!”

Rather than worrying about what you could have done at 22, worry about what you can do before you’re 33. It’s never too late to start taking advantage of time.

If you aren’t convinced, consider that if you invested $2,500 (about $208.33 per month) like Eric and Jack, waiting just one year would cost you around $34,000.

Still want to wait until next year?

Didn’t think so.

How to Get Started

We all waste money on things that aren’t that important to us, and even if retirement is 43 years away, investing in our future is important.

The opportunity cost of Time lost is not worth it.

The solution? Cut spending on the things you don’t love and set up a system to pay yourself first, before you spend money on things that don’t matter to you.

For example, you can cut your cable bill or insurance rate by negotiating and shopping around. Take the money you save every month and contribute it.

You can start small—easy wins help you get over your resistance.

Here are some examples of the things you might want to cut:

Sodas

Cigarettes

Lattes

Cable TV

Games

Sweets

New Gadgets

Shopping

Driving a Big Car

Eating Out

Partying

This doesn’t mean you don’t get to indulge and have fun—what’s the point of investing in your future, if you aren’t enjoying your present?

But pick the ones you enjoy the least and cut those.

If you LOVE your daily frappuccino before work, then cut eating out once a week instead.

If you spend too much time in front of the television and want to change that, cancel your cable TV.

If you still want games or new gadgets, try delaying your purchases and contribute the money you saved when the price drops.

Spend on what you love, but cut ruthlessly on the things that don’t matter or are outright destructive—and put what you save toward enjoying your future.

Take Advantage of “Free” Money

If you need another reason to start investing in your retirement now, and you’re a full-time hourly or salaried employee, then take a look at your 401(k) plan.

There are two great benefits to a 401(k) and similar plans, like 457 and 403(b):

Employees often will match what you contribute—sometimes as much as dollar-for-dollar. The only work you do for that money is your own contribution. It’s free money.

Tax-deferral allows you to subtract your contribution from your income, so you pay less in state and federal taxes. The money you contribute also grows, tax-free, until you withdraw it.

You can take advantage of those benefits immediately.

Another place to look for tax-deferrals are IRAs, including “rollover” traditional IRAs and ROTH IRAs.

Struggling with where to start? Just ask and I can help……

Have a comment or a success story? Please share it…..

0 Comments